This post is a submission for the 20SB Blog Carnival on Friends & Money.

The blog carnival is sponsored by Charles Schwab, which happens to be my long-time bank. I've been "talking to Chuck" since I first started fumbling through my finances as an independent adult; Schwab has helped me save and invest and cash-out for big purchases, always with great customer service.

20SB is an awesome community of 20-something bloggers with a membership of 12,000+ strong - I highly recommend checking it out. If you are already a member let's be friends! Check-out the new 20SB Cafe Press Store too...I just bought myself a nice little tank top for summer.

Freedom: My Money Manifesto

I've talked before about how we all have different motivations when it comes to money; that money is merely a means to an end. My end is freedom (by way of independence) - and it is based on two core principles:

- I made a promise to myself a long time ago - before I ever started collecting paychecks - to never stay in a job or a relationship because I can't afford to leave.

- When I was in college my mom told me that even if I get married someday, I should always know how to support myself. I should always know where my money is going, how to bring home a steady paycheck, and how to pay the bills if anything ever happened (like death or divorce).

These two ideas drive almost every financial decision I have ever made. Since the day I started earning money consistently in college, I have always had a second source of income on the side. Whether it was getting paid to take lecture notes, babysitting, doing web development tutoring, coaching or most recently the book - I have always had my main paycheck and my "hustle" check.

Both fund my independence. Independence from credit card debt and from the fear or not being able to pay my bills on time. It is important to me that I'm not waiting for or depending on another person to fund my financial goals. Of course I look forward to dreaming with the person I eventually marry and to making big things happen as a team, but I won't go into a marriage expecting him to save me or to pay for things that I couldn't pay for myself.

So I bought myself a condo, a diamond ring and a new car (paid in full). I max out my 401(k). I am still paying off my student loan, but I don't have credit card debt. I scored 95/100 on Charles Schwab's Financial Fitness Check-Up Tool. According to the quiz, the only thing I'm missing is a will (I'll get on that soon, Suze, I promise!). I realize that some people might feel suffocated or tied down by these purchases - the exact opposite of freedom - but for me, they create a sense of comfort. I'm not sharing my financial report card to make you feel bad - and I really hope I haven't. I'm sharing because it's important to me that I put my money where my mouth is.

My mouth is on freedom and independence - on always being able to support myself. I bought those things because they helped me feel free. And if there is anything I want to tell or show my friends about money, it is that you can get a handle on it too.

It is important to note that we are all in different places - some have high paying jobs, some do not. Some don't have jobs at all. Some have families who can help out, some do not. I am incredibly fortunate to have had a steady paycheck for the last six years, and a family that is willing to help me out a little bit when I stretch to make big purchases.

Friends and Money

This post is supposed to be about friends and money. I try to stay out of my friends' business when it comes to money, but I find that a lot of them come to me for help, advice, or even just a little inspiration.

In the last two years, two of my friends got divorced. One was married for 15 years, and met her husband when she was 20 years old. The other was married for 10, and has a young daughter to support. When they couldn't see the other side of their financial picture, I helped reassure them that it would be okay. That they could get their finances figured out. That they could learn how to pay bills and rent on their own, even though for many years they had shared those responsibilities with another person.

I wanted to show my friends that they could stand on their own two financial feet even as they walked through heartache. I was living proof that you can be a single woman, manage your money, and still find ways to be fabulous. They looked to me and I told them it would all work out. That I would be right here. And that they could do it. And they did.

It's Never Too Late

It doesn't matter whether you are 25 or 45 years old, it is never too late to start getting a handle on your money. If you are looking for a place to start, I suggest the following three things:

- Admit your fears and flaws -- what are you afraid of? What are your biggest financial weaknesses? What do you avoid when it comes to managing your money? Check out my previous post: The Emotional Side of Money.

- Raise your Awareness -- what is your current state of affairs? How much money do you have in the bank? How much debt? What is your monthly income and outflow? Check out my Four-Step Budget for help getting this figured out.

- Start somewhere -- At the very least, sign-up for Mint.com so that you know where your money is going. Next step? Set-up a short-term savings account (I use ING Direct), and start having $50 automatically deposited every month for an Emergency Fund. To see how I distribute my money, check out A Day in the Life of My Paycheck.

My Hope for All of Us

What I want most for myself, for my friends, and for all of you is to see money as a source of freedom, not imprisonment. Of empowerment, not guilt or shame. Of conscious choices, not feelings of frustration or ignorance. No matter where you are starting from today, I know that you can do it.

Forget for a minute about how much money you have in the bank. I wish I could look you square in the eyes, but for now just hear me when I say: you are worth a million dollars, no matter what your bank statement says. You are smart, creative and resourceful. There is nothing you can't figure out. Even this. Especially this.

***

For more Schwab resources: check-out their new site aimed at young adults. They have also recently launched Money Mondays, a series of weekly money tips, and a Twitter account @schwabmoneywise. To submit a post for the 20SB Blog Carnival, post drop a link to your post here by midnight on June 30th, and tweet with the hashtag #$friends.

Disclaimer: This post is part of the 20SB Blog Carnival: Friends & Money, sponsored by Charles Schwab. Prizes may be awarded to selected posts. The information and opinions expressed in this post do not reflect the views or opinions of Charles Schwab. Details on the event, eligibility, and a complete list of participating bloggers can be found here.

Jenny's Note: This is a guest post from

Jenny's Note: This is a guest post from

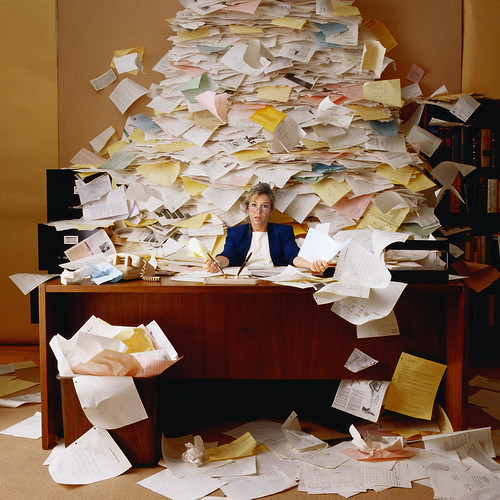

I find it easy to get buried in the busyness of work. Scratch that. I find it easy for my entire identity to get wrapped up in my work. Sometimes I don't even know who I am if not a Googler or a Blogger or a Coach or an {insert label here}.

I find it easy to get buried in the busyness of work. Scratch that. I find it easy for my entire identity to get wrapped up in my work. Sometimes I don't even know who I am if not a Googler or a Blogger or a Coach or an {insert label here}.